I understand the overseas bitcoin mining supervision policy

With the skyrocketing currency price in recent times, the Iranian government cut off the power supply of some illegal bitcoin miners, and this excitement suddenly occupied the headline of the domestic blockchain media. Following the rise in the price of coins, the computing power also followed the rise. According to authoritative data, as of July 1, the bitcoin mining power has exceeded 69 hashes per second, indicating that investors’ interest in bitcoin mining continues to increase.

However, the Iranian government’s practice clearly told us that Bitcoin’s regulatory policy is a step forward in the development of bitcoin mining. Although mining supervision in some countries does have pressure, the entire mining system is relatively positive. But it is undeniable that price volatility and regulatory policies remain the main obstacles to mining. Based on Iran's recent bitcoin mining regulation, we have studied in depth the regulatory policies of several countries where bitcoin mining is active, and analyzed their positions and regulations on bitcoin mining in the past few years.

Overseas Bitcoin Mining Regulation Policy

I. China mining supervision policy

The Chinese government’s attitude toward bitcoin mining has always been relatively straightforward. At present, the use of bitcoin transactions is tough, such as prohibiting bitcoin transactions, ICO, and opening cryptocurrency exchanges.

But even in this environment, China's Bitcoin mining still dominates the world, and China's mining pool is reported to account for 70% of the world's total mining. In addition, the global Bitcoin mining pool industry is dominated by China. The reason may be China's excess electricity supply. Especially the capital of China's mining pool - Sichuan Province. According to reports, the power surplus in the Sichuan mine has forced the power plant to encourage the company to operate mining equipment to make the best use of it.

In April 2019, a government agency proposed to ban mining. If this regulatory policy became, then the leading position of China's bitcoin mining would be unprotected.

This will be a fatal blow to the ant miners that produce the world's hottest ASIC miners. Bitcoin also has its own mining operations in China.

Many reports in 2018 also show that under the increasing mining pressure in China, many mining pool operators are looking for better mines overseas. It is understood that the main concerns of the Chinese authorities are environmental and tax issues.

Second, Russia mining supervision policy

Compared with China, Russia's policy on bitcoin and cryptocurrency is relatively loose, and they have not yet published a clear regulatory stance in this area. Bitcoin is unregulated, but its use as a means of payment for goods and services is illegal. But all this will change in the summer of 2019, because the Digital Financial Assets Act will come into effect.

At present, the country's cryptocurrency mining business continues, with cold weather and low electricity prices as the main drivers. However, a June report showed that mining operators may face fines in the future.

Anatoly Aksakov, chairman of the State Duma Financial Markets Committee, told the Russian News Agency that the cryptocurrency created on the open blockchain was once considered illegal. At the same time, he also stressed that if the cryptocurrency is purchased or acquired abroad, it is not illegal to hold it in Russia.

Third, Iran mining supervision policy

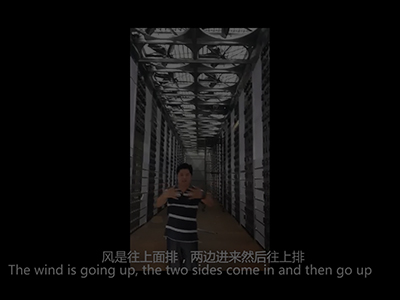

Previous news reported that the Iranian government has been tough on Bitcoin mining due to the sharp increase in electricity consumption in the past month, especially illegal mining. The Iranian Ministry of Energy believes that an abnormal increase of 7% in electricity consumption is caused by mining. They are worried that the grid will be under excessive pressure, so they intend to reduce the rights of the mine until they pass new energy tariffs.

At present, the Iranian people can receive a government subsidy. According to reports, such subsidies make up for the difference between the electricity charges charged by consumers and the actual electricity consumption. This situation provides a favorable environment for cryptocurrency miners. After some Iranian government departments officially accepted Bitcoin mining as a legal industry in the country, the mining ecosystem was approved in September 2018.

In view of the activity and profitability of Iran's mining operations, Iran's Deputy Energy Minister Homayoun Haeri said that the mining industry in Iran should be charged the same as the electricity export charges in June 2019. Although everything seems to be very positive at the end of 2018, Iranian miners may face months of uncertainty until a new policy on tariffs on electricity tariffs is introduced.

Fourth, Canada mining supervision policy

Canada has always positioned itself as a bitcoin-friendly country and has openly opened stores for cryptocurrency mining. Canada has classified bitcoin as a commodity, so users are obligated to pay taxes, depending on how they acquire and use the cryptocurrency. If Bitcoin is used as income, it will be taxed on income. If it is only held, it is also obligated to pay capital gains tax.

According to sources, cryptocurrency mining is also subject to taxation, depending on whether the business is a business or a personal amateur. The latter does not have to pay taxes. It is ok to trade and use cryptocurrencies in the country, but there is some control, especially in mining.

This move was mainly due to a job by the electricity supplier Hydro-Québec and the government energy regulator Régie de l’énergie. In May 2018, the Quebec government suspended the sale of electricity to cryptocurrency mining operators, when 100 mining operations submitted a power purchase application to Hydro-Québec, which reportedly consumes more than 10 terawatts per hour. Hydro-Québec operates 60 hydroelectric power stations, with a remaining electricity generation of about 13 TWh.

In June 2018, Hydro-Québec proposed rules for demanding cryptocurrency mining companies to bid for electricity. The applications of these companies need to be confirmed by a business case, showing the jobs and investments involved in the initiative in the business case. Part of these rules may allow Hydro-Québec to force a reduction in mining power during periods of rising demand for electricity in the province.

Within a few months, the electricity supplier had to suspend the processing of miners because the industry had to use more electricity than it had at the time. Almost a year later, in April 2019, Régiedel'énergie released new rules for the industry that basically solved the problem of miners' electricity purchases.

Hydro-Québec was asked to allocate 300 megawatts to the blockchain industry, exceeding the 158 megawatts already available to existing customers and 210 megawatts from municipal distributors. In order to obtain this allocated electricity, mining companies must pass a screening process. The main evaluation criteria include the number of jobs created, the salary of the position, the valuation of the investment, and the heat recovery.

V. Czech and Icelandic mining supervision policies

The policy of the Czech Republic is worth seeing because it is home to Slushpool, one of the largest mines in the world. The mine station has a global total power distribution of 7.5%. This European country is relatively loosely regulated for bitcoin and other cryptocurrencies. The government does not consider Bitcoin as the legal tender, but the prize is classified as a single intangible asset.

Similarly, Iceland has become a cryptocurrency mining centre due to the cold climate and abundant renewable energy. In February 2018, it was speculated that the electricity consumption of the industry would exceed the total household electricity consumption in the country. According to reports, Genesis Mining is the largest energy consumer in Iceland.

6. US mining supervision policy

The US bitcoin mining is also very developed, and the United States has adopted a fairly pragmatic approach to regulation. The US Commodity Futures Trading Commission (CFTC) classified Bitcoin as a commodity in September 2015 and is still a commodity. There are no specific restrictions on mining activities, but some states have adopted different approaches to cryptocurrency.

The city of Plattsburgh in New York may be the only place in the United States that officially bans cryptocurrency mining. In March 2018, the initiative was formally proposed because local residents complained that cryptocurrency mining led to an increase in electricity bills. The city is located near hydropower stations and has low electricity. According to reports, in March last year, the largest mine in Plattsburg occupied 10% of the city's electricity. Therefore, the Plattsburg City Council implemented an 18-month cryptocurrency mining ban.

A report by the Crescent Electric Supply Company last year listed the cost of electricity to dig a bitcoin in the US states. Louisiana is considered to be the cheapest place to dig bitcoin. This is followed by Idaho, Washington, Tennessee, and Arkansas. GigaWatt is the largest mine in the United States and is located in Washington.

Global Bitcoin mining supervision phenomenon

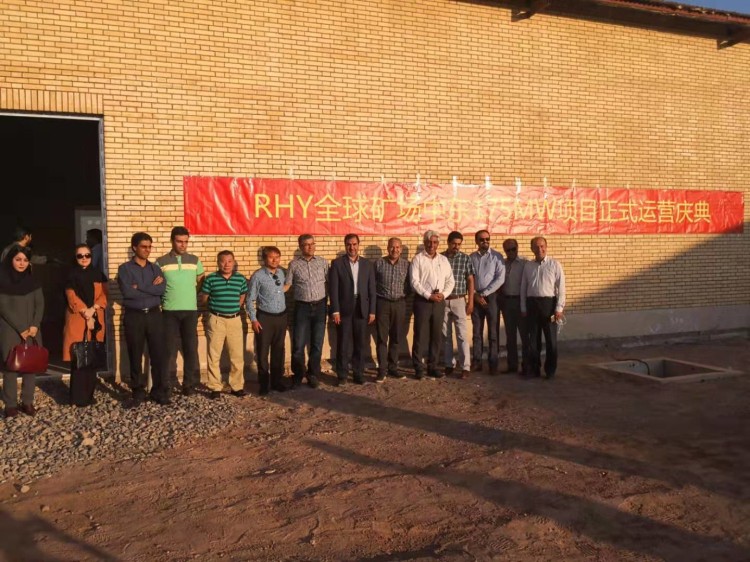

In fact, bitcoin mining has become a global phenomenon, and regulatory policies are also different. At present, there are still many countries that welcome bitcoin, such as the Middle East. In addition, the mining electricity bill in the Middle East is very cheap. The RHY mines, which have been in the Middle East for more than two years, said that their mining electricity costs in the Middle East mines were as low as $0.02763 per kWh, which is much cheaper than the domestic flood season mines. And they are legal large mines, one-time buyouts of mine land, and permanent deadlines. Electricity is sent directly from the power bureau, and the state network is powered. Many domestic miners go overseas to mines and are more inclined to choose a legal large-scale mine like the RHY mine. Because the main factor in the location of large mines is affordable and cheap electricity.